Alameda moves another $15M in Solana as traders watch for market impact

Alameda Research’s bankruptcy estate has distributed another $15 million worth of Solana to creditors, extending a repayment process that has now been running for nearly two years.

Summary

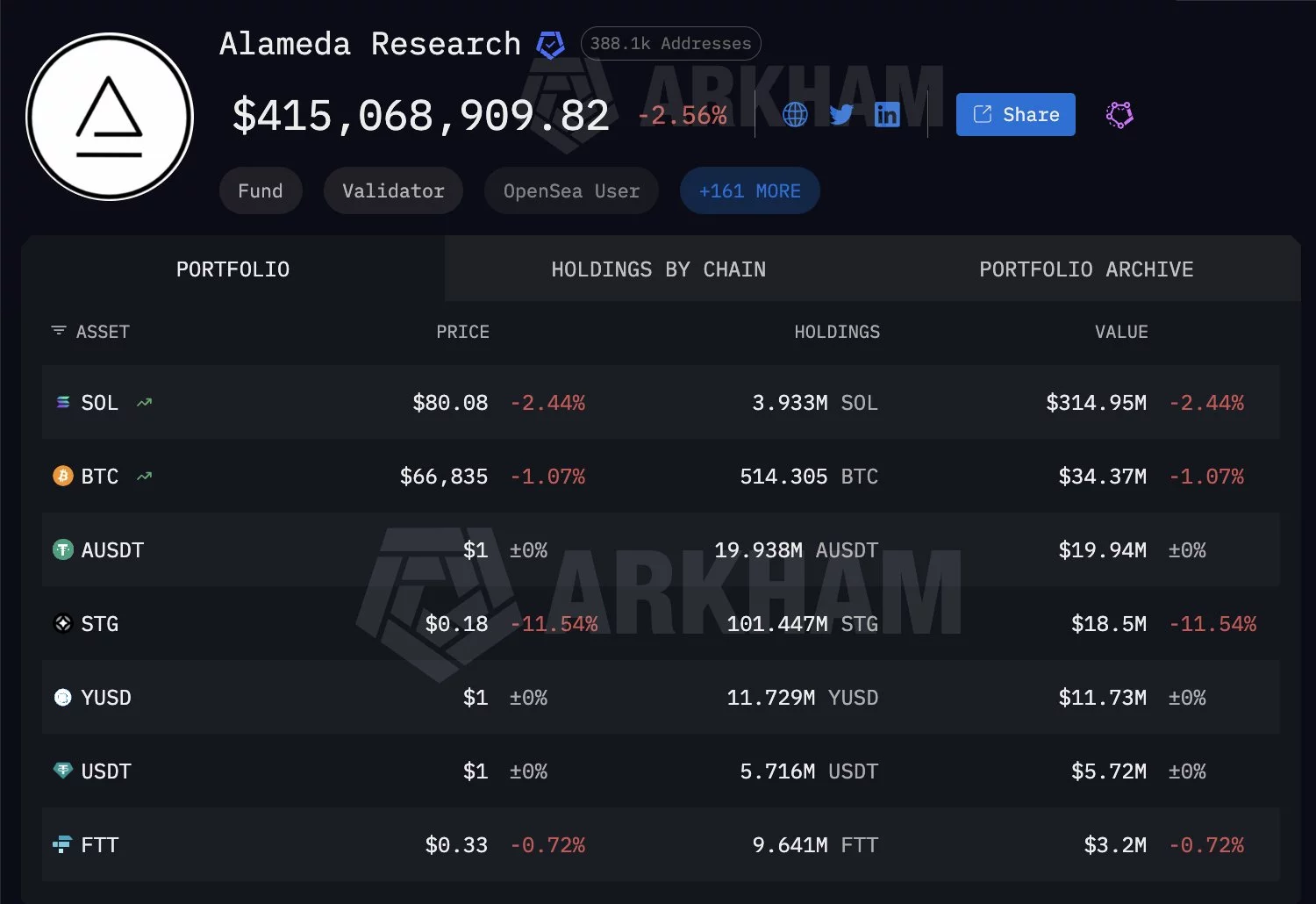

- Alameda Research’s bankruptcy estate distributed roughly $15.6 million in Solana to creditors in its latest monthly payout, extending a repayment process that has run for 21 months.

- Despite ongoing distributions, Alameda still holds nearly $315 million worth of SOL on-chain, keeping traders alert to potential supply overhang risks.

- Most of Alameda and FTX’s SOL was previously sold through OTC deals in 2024, with remaining distributions being handled gradually to limit market impact.

According to blockchain data highlighted by Arkham, the latest monthly tranche involved the transfer of roughly $15.60 million in Solana (SOL) to 25 separate addresses.

The movement forms part of a structured distribution program that has been ongoing for 21 months following the collapse of FTX and its trading arm, Alameda Research.

Despite the steady outflows, Alameda’s on-chain wallets still hold approximately $314.95 million worth of SOL, keeping the estate among the largest known holders of the token tied to the defunct exchange empire.

Market impact questions resurface

The renewed transfers have reignited debate over whether these distributions ultimately translate into sell pressure on the open market.

Arkham raised the question directly, asking whether the newly distributed SOL would be “SOLd straight into the market,” a concern that has repeatedly surfaced during prior repayment rounds.

While the latest tranche is relatively modest compared to Alameda’s historical holdings, traders remain sensitive to any supply overhang tied to creditor payouts, particularly during periods of broader market volatility.

Solana’s native token has been volatile in recent months, trading near the low-to-mid $80s to low $90s range after pulling back from higher levels seen in 2025.

Where Alameda’s SOL went

Additional context was provided by analyst Emmet Gallic, who traced the fate of the bulk of Alameda and FTX’s Solana holdings.

According to the analysis, roughly 43 million SOL was largely sold through over-the-counter deals across three major tranches in 2024, limiting direct market disruption.

Those sales included 26 million SOL at $64 to buyers such as Galaxy, Pantera, Jump, and Multicoin; 14 million SOL at $95 through a Pantera-led consortium; and a further 2 million SOL at $102 involving Figure Markets and Pantera.

Since those OTC sales, remaining SOL distributions have been handled gradually, suggesting a continued effort to balance creditor repayments with market stability. Still, with more than $300 million in SOL left on-chain, Alameda-linked movements are likely to remain a point of close scrutiny for Solana traders in the months ahead.