FLOKI rallies after Robinhood listing, here’s why it could climb even higher

FLOKI is on the verge of a technical breakout, driven by its recent listing on the popular U.S. trading platform Robinhood.

Summary

- FLOKI rose over 11% to $0.000118 on Aug. 8 after debuting on U.S.-based trading platform Robinhood.

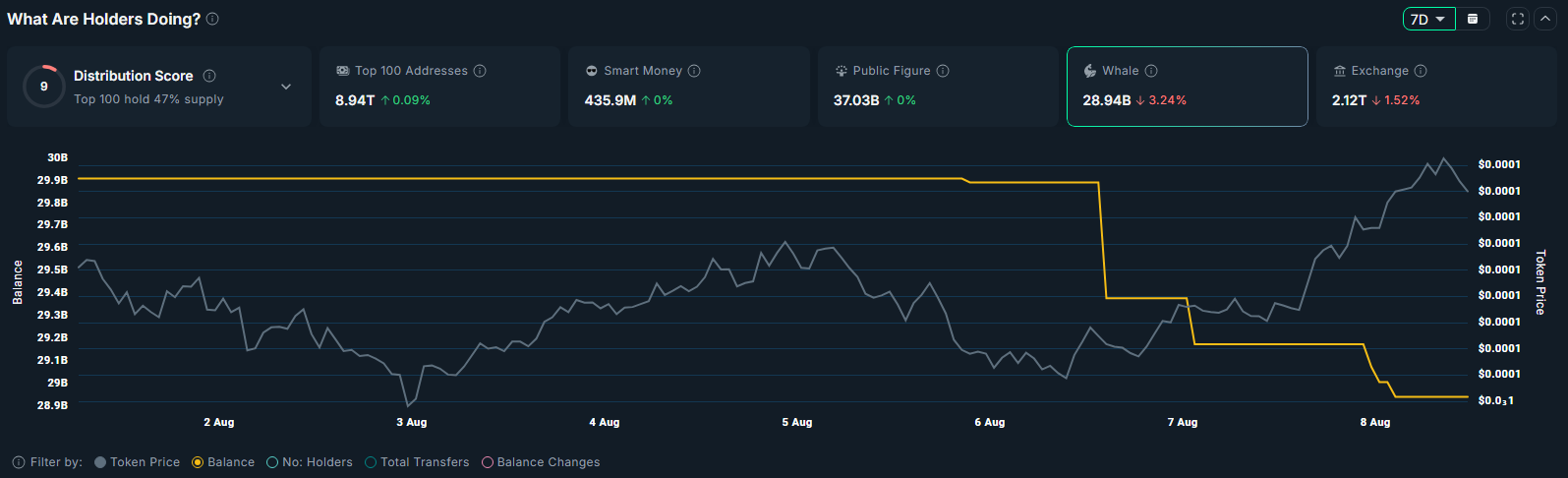

- Whale holdings fell to 28.94 billion tokens from a monthly peak of 30.5 billion.

- Technical signals show breakouts from a falling wedge and double-bottom pattern.

According to data from crypto.news, Floki (FLOKI) climbed over 11% to $0.000118 on Aug. 8 during morning Asian trading before easing slightly to $0.000117 at press time.

Today’s price action was marked by a sharp increase in daily trading activity, with volume up 125% in the past 24 hours.

FLOKI now ranks as the eighth-largest meme coin with a market capitalization of $1.12 billion, trailing behind Official Trump (TRUMP) and SPX6900 (SPX). In the broader market, it sits as the 104th-largest cryptocurrency by market cap.

The primary driver behind FLOKI’s gains today is its debut on the U.S.-based trading platform Robinhood.

In an X post, Floki’s team described the move as a “huge step forward,” noting that it opens access to more than 25 million users on one of the world’s most influential retail trading platforms.

Historically, exchange listings often trigger short-term price spikes, though momentum can fade as speculative buying cools.

However, the listing coincides with mixed on-chain signals. Nansen data shows that whale holdings have dropped from a monthly peak of 30.5 billion tokens to 28.94 billion, indicating some large holders have been selling into strength.

Conversely, the amount of FLOKI held on exchanges has fallen to 2.12 trillion tokens, a 5.1% decrease compared to last month, suggesting reduced immediate selling pressure and potential tightening of circulating supply.

In derivatives markets, sentiment appears more optimistic. CoinGlass data shows futures open interest surged 20% over the past 24 hours to $53.6 million, up from this month’s low of $40.2 million. Rising open interest, especially during an uptrend, often signals that traders are positioning for further upside.

The long/short ratio stands at 0.86, which indicates that short positions currently outnumber longs. If prices continue to climb, this positioning could set the stage for a short squeeze as traders rush to cover losses.

Floki price analysis

On the daily chart, FLOKI had been trading within a falling wedge pattern since late July. A falling wedge is typically considered a bullish formation, as it signals that downward momentum is weakening. A breakout above the upper trendline of this pattern often marks the start of a trend reversal and can lead to sustained upside in the short term.

FLOKI confirmed the breakout on Aug. 4 when it moved above the wedge resistance at $0.000107.

Momentum indicators support the bullish shift. The MACD line is on the verge of crossing above the signal line, with diminishing red histogram bars pointing to fading bearish pressure.

Similarly, its RSI has rebounded from oversold territory to 53 at the time of writing, indicating that buying strength is returning without the market yet entering overbought conditions.

On the 4-hour chart, FLOKI has broken above the neckline of a double-bottom pattern at $0.000113. This setup emerged after the token repeatedly held support near $0.000098, rebounding each time with stronger momentum.

A double bottom is typically seen as a bullish reversal signal, suggesting steady buying interest and improving sentiment, in line with the bullish structure already visible on the daily timeframe.

Based on this confluence of bullish technical signals, the most probable near-term target for FLOKI is $0.000146, which represents the projected move from the breakout and sits roughly 25% above the current price.

On the other hand, if it drops below $0.000098, it would invalidate this setup and open the doors for a deeper correction.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.